The Bitcoin Fear and Greed Index is a powerful tool used by traders and investors to gauge the emotional climate of the cryptocurrency market. This index serves as a psychological barometer, reflecting the collective emotions of market participants. By analyzing fear and greed levels, traders can gain insights into potential market shifts and adjust their strategies accordingly. But how exactly does this index work, and what does it reveal about Bitcoin’s price movements?In this article, we’ll explore how the Bitcoin Fear and Greed Index correlates with Bitcoin prices, how to interpret historical data, and how traders use it to make informed decisions. We’ll also analyze the Bitcoin Fear and Greed Index Chart to understand its predictive value. Let’s dive in!: Curious about how the Bitcoin Fear and Greed Index can predict market trends? Learn how the index works, its relationship with Bitcoin price movements, and how to use it for better trading decisions.

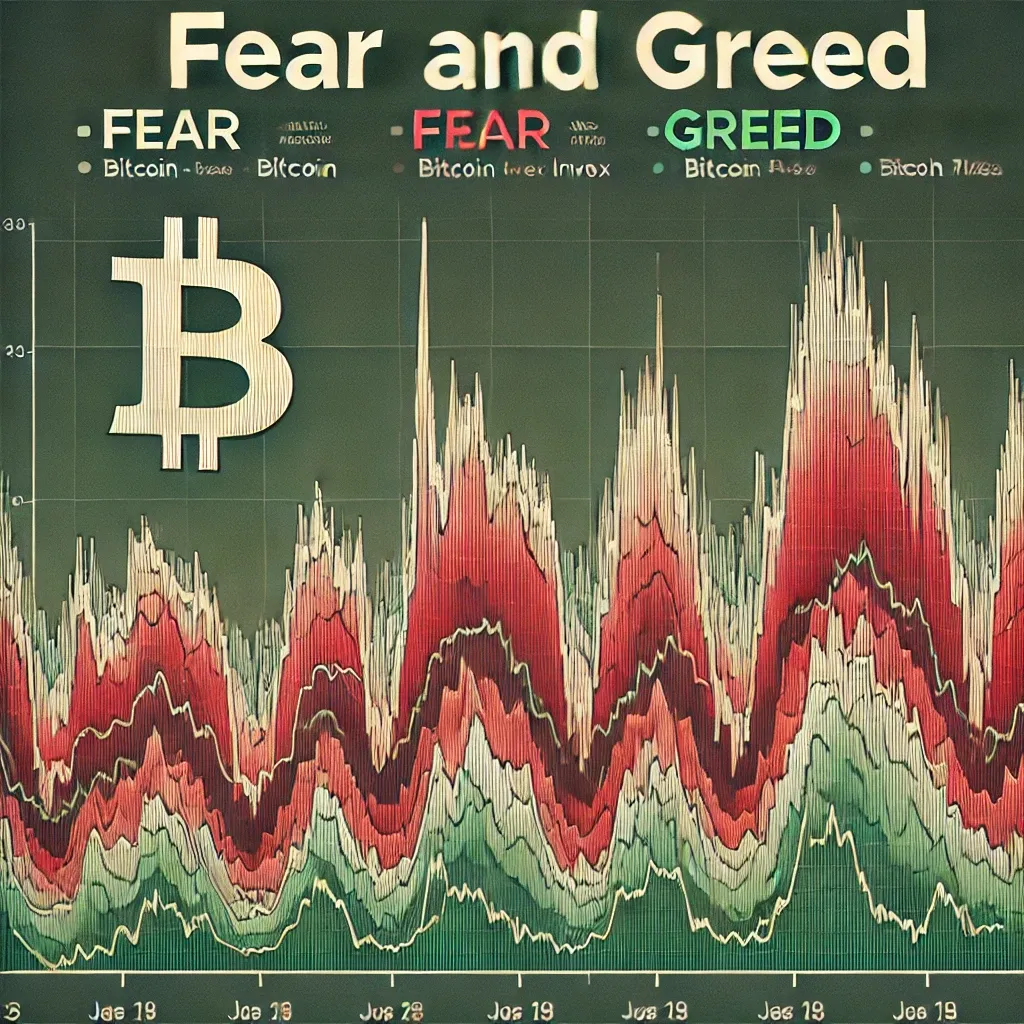

Bitcoin Fear and Greed Index vs Price Chart

The relationship between the Bitcoin Fear and Greed Index and Bitcoin’s price is a subject of keen interest for market observers. The index measures market sentiment by assessing volatility, market momentum, social media activity, surveys, and dominance, which are then translated into a scale from 0 (extreme fear) to 100 (extreme greed).Bitcoin’s price tends to fluctuate based on how fearful or greedy market participants are. When fear dominates, prices often dip, as investors sell off their holdings. Conversely, when greed takes over, prices can skyrocket, driven by FOMO (fear of missing out). This dynamic is what traders focus on when using the Bitcoin Fear and Greed Index.

Key Points to Know:

- Fear tends to indicate lower prices as investors pull back, waiting for a more favorable entry point.

- Greed often signals a bullish market, where prices increase as more people rush to buy in.

- The Bitcoin Fear and Greed Index chart can reveal trends that suggest upcoming market shifts.

- Sudden spikes in fear can signal potential market corrections.

- Conversely, periods of extreme greed can suggest an overbought market, leading to possible price corrections.

The Fear and Greed Index is not a perfect predictor of Bitcoin’s price, but it serves as a valuable tool for spotting market extremes. By observing when fear or greed reaches its peak, traders can position themselves for potential profit opportunities or risk management.

👉 Explore the Bitcoin Fear and Greed Index👈

Bitcoin Fear and Greed Index Historical Chart

Analyzing the historical chart of the Bitcoin Fear and Greed Index is essential for understanding the long-term behavior of the cryptocurrency market. This index has been available for several years, providing valuable insights into how market sentiment has evolved over time.The chart allows traders to track patterns of fear and greed alongside Bitcoin’s price movements, which helps them better understand the psychological dynamics driving the market. For instance, looking back at significant market events—like Bitcoin’s bull run in 2017 or the crash in 2022—can reveal how fear and greed influenced price action.

Historical Insights:

- During Bitcoin bull markets, the index often spikes towards greed levels, reflecting investor optimism and high demand for the cryptocurrency.

- Bear markets and crashes typically coincide with fear spikes, where the index approaches 0, signaling extreme pessimism.

- Key price movements can be tracked against fear and greed patterns, such as when Bitcoin hit an all-time high or corrected dramatically.

Why It Matters:

- Understanding cycles: Traders who analyze the historical chart can identify cyclical behavior of the market. Knowing that periods of extreme greed often precede corrections, investors can plan exits before the market turns.

- Identifying market bottoms: Extreme fear can signal potential buying opportunities, especially when market prices are below historical trends.

By reviewing the Bitcoin Fear and Greed Index historical chart, investors can form a better understanding of how sentiment shifts in relation to Bitcoin’s price. This allows them to time their trades more effectively, avoid panic selling, and stay disciplined during volatile periods.

👉 Dive Into the Historical Chart👈

Understanding the Bitcoin Fear and Greed Index

At its core, the Bitcoin Fear and Greed Index is a sentiment analysis tool designed to track the emotions of traders and investors. It measures the emotional undercurrent of the market, helping market participants make more rational decisions in the face of volatility. Understanding the Fear and Greed Index is key to leveraging it as part of a broader trading strategy.

Key Components:

- Volatility: Large price swings contribute to fear and uncertainty, thus lowering the index.

- Market Momentum: Bullish momentum increases greed, pushing the index upwards.

- Social Media and Surveys: Positive social media mentions of Bitcoin can indicate greed, while negative news can signal fear.

- Bitcoin Dominance: When Bitcoin outperforms other altcoins, it often signals a sense of greed, as investors flock to the leading cryptocurrency.

- Trends in Trading Volume: Increased trading volume usually correlates with either fear or greed, depending on the direction of the market.

By tracking these components, the Bitcoin Fear and Greed Index offers a snapshot of the market’s psychological state, helping investors make better-informed decisions. Traders often use it alongside other technical and fundamental analysis tools to refine their strategies.

Conclusion

The Bitcoin Fear and Greed Index is an invaluable tool for traders looking to understand market sentiment and predict potential price movements. By examining how fear and greed influence Bitcoin’s price, traders can make better decisions about when to buy, sell, or hold. The historical chart provides further insights into recurring market patterns, allowing for more strategic planning. By incorporating the Bitcoin Fear and Greed Index into your trading strategy, you can harness the power of market psychology to stay ahead of the curve.As Warren Buffett famously said, “Be fearful when others are greedy and greedy when others are fearful.” The Bitcoin Fear and Greed Index offers an opportunity to apply this wisdom, helping you navigate the volatile world of cryptocurrency with greater confidence and insight.